By John Stang

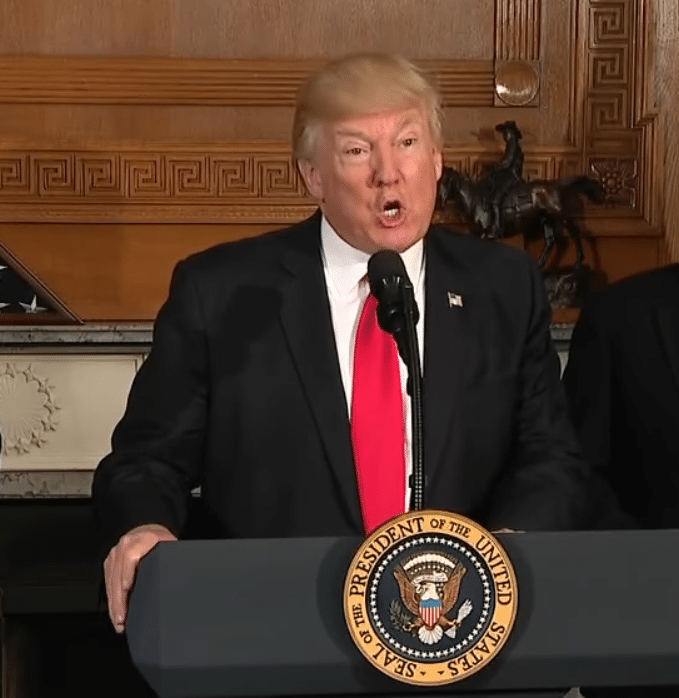

President Donald Trump said Thursday his administration will look into a corporate request to keep FirstEnergy Solutions’ four nuclear power reactors afloat — a statement made after having a Wednesday dinner with a lobbyist for the Ohio company’s parent corporation, FirstEnergy Corp.

In the wake of filing for Chapter 11 bankruptcy protection last Saturday, FirstEnergy Solutions is attempting to keep its four reactors open in Ohio and Pennsylvania. That includes sending a long memorandum asking Energy Secretary Rick Perry to order a regional power clearinghouse to financially bolster FirstEnergy Solutions enough to keep its reactors and other power plants online.

The energy secretary has that authority under Section 202 of the Federal Power Act, which says that office can order struggling power plants be kept online for the greater public good. But on March 30, PJM Interconnection, the regional wholesale power transmissions agency that receives FirstEnergy’s electricity, sent its own letter to Perry arguing FirstEnergy’s announced reactor closures don’t have a currently obvious impact on the agency’s customers.

“We’ll be looking at that 202, you know what a 202 is, we’ll be looking at that, we’re trying,” Trump said Thursday during a trip to White Sulphur Springs, W.Va., according to news reports. “About nine of your people just came up to me outside, could you talk about 202, and we’ll be looking at that as soon as we get back.”

The Washington Post and a watchdog organization, the Nuclear Information and Resource Service, reported that FirstEnergy Corp. lobbyist Jeff Miller hosted a dinner Wednesday evening for Trump. Miller previously served as presidential campaign manager for Perry, the Post reported. He is now an organizer of America First Action, a pro-Trump super PAC, according to NIRS.

In a press lease, NIRS Executive Director Tim Judson said: “We are hoping that this dinner is not going to be a situation where U.S. taxpayers and ratepayers end up picking up the tab for a $3 billion or more bailout of FirstEnergy. It is hard to imagine more of a ‘Washington swamp’ situation than this.”

FirstEnergy spokesman Tom Mulligan declined to comment on Trump’s remarks and the NIRS press release. He said Miller does not represent FirstEnergy Solutions, which is the corporation that made the 202 request.

The Cleveland.com news website and the Washington Post identified Miller as a FirstEnergy Corp. lobbyist.

The Department of Energy said this week — prior to Trump’s remarks — it is continuing to review FirstEnergy’s request for financial and regulatory assistance to sustain operations at its nuclear plants. A DOE spokeswoman did not provide a timeline for processing the request.

Specifically, the company has filed a formal 202c application for Perry to order PJM Interconnection to immediately begin negotiations to use the long-term capacity of FirstEnergy’s nuclear and coal plants. The idea is to provide FirstEnergy Solutions with locked-in revenue that is adequate to meet its financial obligations.

The 202c request also called FirstEnergy’s plants to be compensated “for the full benefits they provide to energy markets and the public at large, including fuel security and diversity,” according to a FirstEnergy Solutions press release issued last week.

Last week, FirstEnergy Solutions announced the closure schedule for the facilities: the 908-megawatt Davis-Besse Nuclear Power Station at Oak Harbor, Ohio, in May 2020; the 1,268-megawatt Perry Nuclear Power Plant at Perry, Ohio, in May 2021; and the and two reactors at the Beaver Valley Power Station north of Pittsburgh that total 1,872 megawatts, in May and October 2021.

The four reactors’ operations licenses from the U.S. Nuclear Regulatory Commission are not scheduled to expire until different times between 2026 and 2047.

But in its filings with the U.S. Security Exchange Commission, FirstEnergy contended that low wholesale electricity prices, weak demand, cash flow issues, and debts leave it economically unable to keep the plants open.

The Washington Post also cited FirstEnergy’s 2010 merger with Allegheny Energy, which left it with $3.8 billion in Allegheny debt plus several coal-fired plants at a time then natural gas prices dropped and made coal power a bad investment.

FirstEnergy Solutions filed for bankruptcy last Saturday in U.S. Bankruptcy Court in the Northern District of Ohio. The company has $7.241 billion in assets and $3.093 billion in liabilities, according to its bankruptcy documents.

The corporation is also legally trying to prevent the Federal Energy Regulatory Commission from enforcing 10 outstanding contracts until further litigation determines whether the struggling electrical power provider will have to honor them. Eight of those 10 contracts are for FirstEnergy to receive wind and solar power, which the corporation entered between 2003 and 2011. At the time the economics for renewable energy contracts were more viable than they are today, according to FirstEnergy’s bankruptcy filings. The other two plants sending electricity to FirstEnergy are powered by coal and natural gas.

U.S. Bankruptcy Judge Alan Koschik granted FirstEnergy Solutions a temporary injunction Monday against FERC enforcing those contracts Monday. A pre-hearing status conference is set for April 9. The hearing on FirstEnergy’s request is April 16.

If FirstEnergy Solutions cannot break free of the 10 contracts listed in the temporary restraining order, it will be on the hook for paying an estimated $58 million annually for the next few years and a total of $765 million in the long term, court documents said.

FirstEnergy contends the impending closure of its plants threatens the long-term robustness of the region’s electric grid. It argues its plants still have many years of potential life as generators, but cannot economically compete under current market conditions.

On March 30, Vincent Duane, PJM senior vice president for law, compliance, and external affairs, wrote a letter to Perry disputing some of FirstEnergy’s contentions. Duane asked the DOE chief to hold off on taking immediate action.