Despite its lack of movement for nearly a year, there remains hope for legislation intended to give a strong push for building a nuclear waste repository at Yucca Mountain in Nevada, a senior official with the nuclear industry’s policy organization said this week.

Rep. John Shimkus’ (R-Ill.) H.R. 3053, the Nuclear Waste Policy Amendments Act of 2017, passed out of the House Energy and Commerce Committee in a nearly unanimous vote last June. It still has not reached the House floor, but its backers have publicly remained optimistic.

“I believe within the next month or so we will go to the floor. It will be one of the few bipartisan successes in this town. The committee vote was 49-4. Does anything pass 49-4 anymore?” said Rod McCullum, senior director for used fuel and decommissioning at the Nuclear Energy Institute.

McCullum told RadWaste Monitor his optimism is based on Shimkus’ tireless work behind the scenes and engagement with House leadership on the bill. He acknowledged its chances are more precarious in the Senate, where lawmakers have been skeptical of Yucca Mountain and where Sen. Dean Heller (R-Nev.) has vowed to keep more nuclear waste from entering his state.

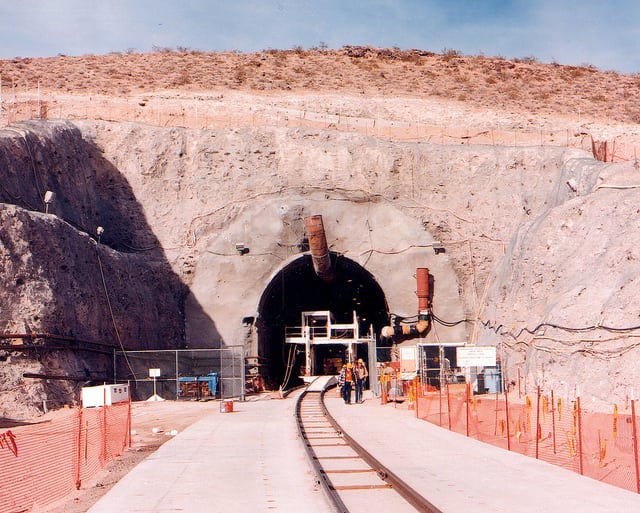

It has been more than three decades since Congress designated Nye County, Nev., as the location for final underground disposal of tens of thousands of tons of spent nuclear reactor fuel and high-level radioactive waste. The project has made little progress, was canceled by the Obama administration and then revived by the Trump White House, which hasn’t yet persuaded Congress to pay for restarting the Department of Energy license application with the Nuclear Regulatory Commission.

While the Shimkus bill wouldn’t fund work on Yucca Mountain, it would speed up the transfer of authority for the federal property from the Interior Department to DOE and make clear the 147,000-acre plot would nearly fully be used for nuclear waste disposal, among other measures. It would also authorize the Energy Department to contract with a non-federal entity for interim storage of spent fuel until the permanent repository is ready.

Until the spent fuel is taken away from the nuclear power plants that generated it, managing the material will remain a major challenge to site owners and decommissioning providers, McCullum said. That comes even as the decommissioning market is growing increasingly efficient and new models are showing the way forward, he said.

Nuclear services provider EnergySolutions, of Salt Lake City, has created subsidiaries to take over the licenses of plants in Illinois and Wisconsin for decommissioning, eventually returning them to the owners. New York City-based NorthStar Group Services plans to buy the Vermont Yankee nuclear power plant outright for decommissioning and aims to partner with Orano (formerly AREVA) on similar projects at other sites.

In a telephone interview, McCullum discussed the future of nuclear power decommissioning, federal regulation, and whether Yucca Mountain will ever become reality. The former DOE nuclear engineer, who has been with NEI since 1998, will join a host of industry and government representatives in June at the ExchangeMonitor’s Decommissioning Strategy Forum in Nashville, Tenn., where he will moderate a panel on nuclear decommissioning regulations.

This interview has been edited for clarity and length.

Nuclear decommissioning has been part of your portfolio since 2014. Beyond the fact of more reactors closing over that period, has the landscape on U.S. decommissioning changed significantly over the last four years?

Yes, I think we’re getting more efficient at it.

One of the reasons I took on that as part of my title in 2014 was because we were seeking to advance a rulemaking at NRC, and that rulemaking is now in process.

The NRC has great regulations for how you decommission a nuclear plant. Radiological safety and everything else is well established – we’ve safely decommissioned 10 plants all the way, those are done, and several others in process.

But they didn’t have any regulations at all for how you govern the transition between operating plant and decommissioning plant. Obviously there’s a lot less nuclear safety risk when you’re a decommissioning plant. You don’t have a reactor, so a lot of requirements oriented towards reactors are no longer applicable. But they don’t automatically become no longer applicable. Under the existing process you have to file exemption requests and license amendments to render those unnecessary requirements no longer applicable, and that was costing us millions of dollars per plant.

So the purpose of the rulemaking is to make effective by rule automatically that transition from operating rules to decommissioning rules. That will save millions of dollars per plant, it will let plants get to the active decommissioning quicker and they will save decommissioning trust fund resources that they can apply to that.

In addition to the regulatory efficiency, we’re looking to capitalize on all the experience. The change to the landscape is really improving the efficiency of decommissioning and how we manage decommissioning costs. On one side of it is that regulatory piece. But I think an even bigger side is the business model piece.

You’ve seen with ZionSolutions has done, and LaCrosse Solutions, basically EnergySolutions … and how you’re seeing what NorthStar is seeking to do at Vermont Yankee, you’re seeing experienced decommissioning firms getting in there and using the experience we’ve gained to really figure out how best to use the resources we have. As in anything, when it’s first of a kind it’s not as cost-effective as when you’re very good and experienced at it.

We’re turning over nuclear plants that are good at decommissioning. Operating a nuclear plant is a different thing than decommissioning a nuclear plant. So we’ve got these firms out there, from your EnergySolutions to your NorthStars to your Oranos. You have a number of companies that are very good at decommissioning and have learned from all the experience.

They know how to manage the projects. There’s an element of project management skill and these are very specific types of projects. What you’re seeing is innovation in business models: We’re capitalizing on our experience to make decommissioning more efficient. That’s important. Decommissioning is part of the life cycle of a nuclear plant, so we need to have that be as cost effective as any other part of the life cycle of a nuclear plant.

Is the NRC’s decommissioning rulemaking heading in the right direction, is anything being left out of the actual rulemaking?

Overall, the rulemaking is heading in the right direction. There are a couple areas where we’ve commented.

There’s just a couple things they’ve left out of the rulemaking where we could get a couple more efficiencies. But basically the quotable answer is the rulemaking is trending in the right direction. There are a few additional things we’d like to see them get in there.

A lot of things they were considering in rulemaking that wouldn’t have improved efficiency they’ve decided not to include in rulemaking. However, there is a possibility they could include those in additional guidance, and we need to see what that looks like but we don’t think that’s necessary.

The next round, when they publish the draft rule and they publish the guidance, we’ll look carefully at that guidance. If it doesn’t comport with the efficiency improvements we’re gaining through the rules we’ll comment on those areas again.

Can you say what those areas are and why the guidance isn’t necessary?

In addition to the efficiency improvements, there were stakeholders that asked for additional requirements to be placed on the post-shutdown decommissioning activities report. Things on public participation, which has nothing to do with safety. Public participation is between the owner of the plant and the community, and it works differently at every plant because every community is different.

The NRC should not be making requirements on public participation, the NRC should not be requiring additional material to go into the PSDAR that’s not related to their safety mission.

Most of the guidance they’re talking about would make the PSDAR’s thicker, and most of the information that would be added has nothing to do with safety. So we would question why would the regulator or nuclear safety be asking us to put that information in the PSDAR.

I don’t want to detract too much from the positive message that the rulemaking is heading in the right direction, and it is apparently proceeding on schedule. We had in the past gone on record saying that this should not take until the end of 2019.

We’d like to see it earlier, that is true. Because you look at the time frames for shutting plants down, there are plants that will shut down in 2019 that will have to go through this painstaking exemption process because the rule won’t be effective yet.

Those efficiency improvements are not going to be in place in time for all the plants. But then you look at the plants that are now shutting down in the mid- to early 2020s, you look at the delay in shutting down Palisades, well now Palisades will benefit from the rulemaking. So there is substantial benefit, and at the end of the day all of the power plants are going to shut down. By the time we get to those that are still going to be in operation for decades I think we’re going to have a pretty efficient process.

The decommissioning business models we’ve seen in recent years, do you anticipate unique approaches like that becoming more widespread?

I would say not only more widespread but inevitable. When we consolidate the expertise and we figure out how to best use that expertise, obviously we’re going to do business differently.

I’m not going to comment on whose business model’s going to be more popular than who else’s business model, but I think it is the inevitable capitalization on what we’ve learned that you’re seeing these business models.

Are there potential business models that haven’t yet been enacted?

There might be, but I’m not going to get ahead of any of the companies.

As more reactors close, what are the opportunities and what are the challenges for companies in the decommissioning market?

Well, the opportunities are the economies of scale – You’re going to have a decommissioning workforce kind of like you have a nuclear outage workforce. Look what has happened with nuclear outages; we have this highly skilled workforce that all they do is go from plant to plant, and look how efficient the nuclear outages are.

I can see decommissioning, it’s kind of like your last outage. The way you’ve seen outages shrink, I can see decommissioning processes improving.

The challenge is spent fuel. That’s still the long pole in the tent. You’re going to see some activity in Congress coming up soon, I think H.R. 3053 is going to move the ball forward at least a few yards. I think it will get to the floor of the House and then we’ll all turn our eyes to the Senate and say, “OK, what’s up?” We’ll see where that goes, we’re still hopeful there.

Of course, when you’re talking about the used fuel issue there’s a lot of politics involved, and I really can’t go into that.

The challenge is how do we make progress in the biggest cost driver of all, which is used fuel.

How does that affect the decommissioning process, the decommissioning decision-making, in knowing that you’re still stuck with that spent fuel?

You have to look at the long-term maintenance of an [independent spent fuel storage installation]. What type of personnel that you have to have on-site when you’re managing used fuel. The licensing aspects of managing spent fuel. The aging management aspects, I think that’s one that is going to be really significant going forward.

You have seen recently that we’ve renewed dry storage licenses. We’ve talked about extending reactor licenses from 60 to 80 years, we’re now extending dry storage licenses from 20 to 60 years, 40-year extensions, because we’ve learned enough about them that NRC’s comfortable going that far out.

So you’re going to have in place an aging management program, you’re going to have in place licensing and technical people, management people, security people. And then obviously while you still have fuel in the pool you’re dealing with operating systems.

One of the things in the landscape that is changing is people are moving out of the pool faster. ZionSolutions completely emptied the Zion pool in a year. You’re looking at Accelerated Decommissioning Partners, I think that’s one of the main aspects of the word accelerated in their title. Everybody wants to get to dry storage faster, and once you’re in dry storage you still have to manage that facility.

H.R. 3053 has been waiting for action on the House floor for 10 months or so now. What gives you optimism that it’s heading toward a vote?

My optimism is based on the fact that we’re still seeing Congressman Shimkus himself tirelessly working for it, we’re seeing him engaged with the House leadership.

I believe within the next month or so we will go to the floor. It will be one of the few bipartisan successes in this town. The committee vote was 49-4. Does anything pass 49-4 anymore?

You can quote NEI’s technical guys making a prediction on legislation and that won’t get you very far, but I am confident that it will reach the floor, and that confidence is based on the fact that Chairman Shimkus has visibly remained fully engaged. The leadership appears responsive to his engagement and I await that day. Soon.

Then what happens in the Senate?

It’s too early to predict. There’s obviously the position Senator Heller of Nevada has staked out. There’s obviously an election in November.

The Senate will probably start out in the place where they were the last time they introduced legislation, which is more focused on interim storage. H.R. 3053, for the first time, authorizes interim storage. This is the first time the House has recognized we should do that. Some will say it doesn’t go far enough, some won’t.

So you’re going to have a Senate bill that’s probably more focused on interim storage and you’re going to have to conference those two things.

The Senate could just ignore what the House does, but if the House passes it by a large bipartisan majority it becomes really hard for the Senate just to ignore it. But you are going to have two very different things that are going to have to be conferenced.

Beyond the Shimkus bill, what is the likelihood of Yucca Mountain ever actually coming into existence?

I think the likelihood of Yucca is strong. You’ve got the investment in science which has produced a very strong basis for concluding the site is safe. You have a million-year safety case that has been determined to be in full compliance with all regulations by NRC.

What it takes is completing the next step in the process, which is Nevada’s objections can and should be heard in court, which is the NRC adjudicatory process. Whether that goes to other courts outside of NRC I won’t speculate on.

You do need to pursue the adjudicatory process, the next stage in the licensing process. I believe that at some point Congress will fund that. There’s a writ of mandamus by the U.S. Court of Appeals to NRC saying you must complete the licensing process. NRC’s only reason for not complying with that is because they have no money to do so. They have been doing what they can with carryover funds.

I think we get through that process, then you have a facility that’s licensed, then the question is will Congress fund actually building it. H.R. 3053 will help there, of course Congress can still do what Congress does.

You could spend decades studying a new site and you might find a site as good as Yucca Mountain. I don’t think you’ll ever find a better one, so I would hope we’d stay where we have invested our money to date.