Nuclear services firm EnergySolutions on Tuesday announced its first foray into the burgeoning business for buying retired nuclear power plants for decommissioning.

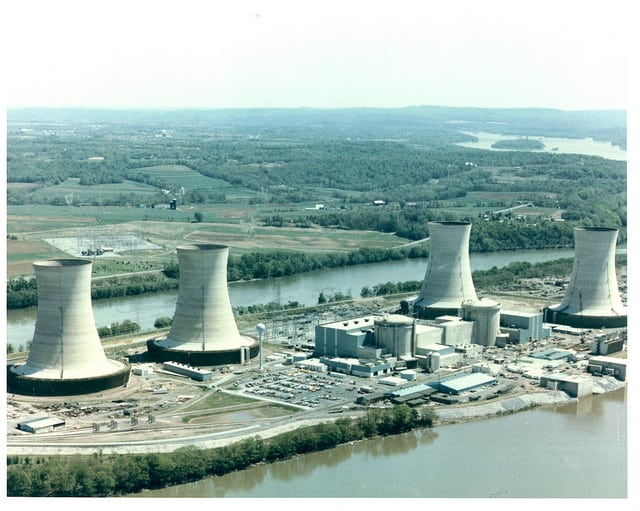

The Salt Lake City-based company said it had inked a term sheet with a subsidiary of FirstEnergy Corp. for the asset transfer of reactor Unit 2 at the Three Mile Island Nuclear Generating Station (TMI-2) in Dauphin County, Pa. The reactor has been shuttered since famously partially melting down and leaking radiation in 1979 after just a few months of operations.

When the sale is finalized, EnergySolutions would own “the plant, property, nuclear decommissioning trust, and plant license as well as the responsibility for decommissioning,” FirstEnergy Corp. President and CEO Chuck Jones said Wednesday during a conference call on the Akron, Ohio, company’s second-quarter earnings report.

EnergySolutions said it would partner with New Jersey construction firm Jingoli on the project, under the limited liability company ES/Jingoli Decommissioning.

The next steps in the deal will be to sign final agreements and file a license transfer application for TMI-2 with the U.S. Nuclear Regulatory Commission. EnergySolutions and FirstEnergy this week did not release the schedule for that process. The prospective plant owner also did not discuss whether its projected timeline for radiological decontamination, dismantlement, and waste removal at Unit 2 differs from FirstEnergy’s plan to complete that mission by 2053.

“We are looking forward to working with FirstEnergy to acquire the asset and to safely complete the decommissioning of the site,” EnergySolutions President and CEO Ken Robuck said in a press release. “Our extensive experience allows us to continue to refine our Decommissioning Management Model, which builds on each project by incorporating lessons learned and utilizing leading technologies that have been proven successful.”

EnergySolutions has an extensive background in carrying out technically complex nuclear decommissionings, including its recently completed work on the Southwest Experimental Fast Oxide Reactor (SEFOR) in Arkansas. It is the prime contractor for decommissioning of the Zion Nuclear Power Station in Illinois and the La Crosse Boiling Water Reactor in Wisconsin, and is gearing up for jobs at the San Onofre Nuclear Generating Station in California (in partnership with AECOM) and the Fort Calhoun Station in Nebraska (supporting the plant’s owner, the Omaha Public Power District).

Jingoli has also worked at atomic energy sites in the United States and Canada, including building dry storage pads for used reactor fuel in New Jersey and Pennsylvania.

However, EnergySolutions has never owned the facility it was decommissioning. Acquisition has been an increasingly popular approach for the nuclear industry in the last couple years, with the owner selling off the property to a specialist to manage decommissioning, site restoration, and spent fuel management. The nuclear power provider is then freed from any responsibility for cleanup and the new owner can make a profit by completing that job for less than the amount of the fund established to pay for the work – which it gets as part of the sale. For the public, the anticipated timeline for eliminating a local radioactively contaminated facility can be shortened from decades to less than 10 years.

The sale of the Vermont Yankee nuclear power plant set the template for this approach. New York City-based demolition and environmental services provider NorthStar Group Services completed the acquisition in January of this year, just over four years after the Entergy facility closed and following state and federal regulatory approval. Decommissioning is now underway.

NorthStar paid a nominal $1,000 for the facility and its decommissioning trust fund. While parties have said little about the terms of nuclear site sales now in the making, they are likely to have adhered to a similar template.

NorthStar in 2017 joined with the U.S. branch of French nuclear company Orano to form Accelerated Decommissioning Partners. That venture is seeking to pick up additional properties, though its first contract win did not exactly line up with that business plan: It will become the licensed operator of the Crystal River power plant in Florida, but Duke Energy will remain the owner because the facility is part of a larger energy generation complex.

Meanwhile, Camden, N.J., energy technology company Holtec International has announced plans to buy nuclear facilities in Massachusetts, Michigan, New Jersey, and New York. It has already become the owner of the retired Oyster Creek Nuclear Generating Station in New Jersey.

As more facilities are closed in the face of economic challenges, including the low cost of natural gas as a power source, decommissioning is the best bet for nuclear companies to seek profit, one informed source said Thursday. As of January, 12 U.S. reactors were scheduled for closure in coming years, according to Forbes. One of those, the Pilgrim Nuclear Power Station in Massachusetts, shut down on May 31. Two plants in Ohio, meanwhile, will remain open after the state this week approved a bailout plan.

If utilities increasingly expect divestment as an option for dealing with their properties, other companies in the decommissioning field might have to put their own spin on it, according to that industry insider. The source listed several names, including AECOM, Fluor, Atkins, and Bechtel, without saying any had actually taken this step.

Atkins is owned by Canadian engineering giant SNC-Lavalin, which is already partnering with Holtec on its decommissioning projects.

These kinds of partnerships will be key to the success of current and future endeavours, a second source said Thursday, bringing together expertise in radiological remediation, demolition, and other fields. He played down the likelihood of overcrowding for this business.

“I think they really see this as an opportunity,” the source said. “You need at least three to have a good competitive marketplace.”

The challenge could instead be the availability of experienced managers to lead a decommissioning job, the first source said. There might be only a half-dozen people working in the United States with the experience and know-how to head up such a project, which can cost upward of $1 billion or more. Decommissioning of two reactors at San Onofre alone is projected to cost $4.4 billion.

“This is high-hazard nuclear work,” that source said. “You don’t want to put the second-stringer in as quarterback when the game is on the line.”

Even companies with deep experience in the business can face unexpected challenges – EnergySolutions indicated in June it would use its own cash reserves for cleanup at Zion after the Exelon plant’s decommissioning trust ran short of the needed funding.

There are any number of other complex issues that might not be immediately apparent, another industry source said. For example: The new plant owner assumes responsibility for managing relations with the surrounding community, which is already feeling the impact from the loss of jobs and tax revenue when the facility closes. They are effectively swapping in for a nuclear utility with a deep history in an area.

Companies must also be able to prove they have the financial wherewithal to meet their decommissioning commitments – a concern raised on several developing deals by local and state governments in New Jersey and Massachusetts, among other stakeholders.

In a settlement agreement with several state agencies and other parties in the Vermont Yankee sale, NorthStar and site owner Entergy offered a multi-part financial assurance agreement on top of the trust fund. Among its provisions: A $140 million support agreement from NorthStar paid to a decommissioning completion trust. NorthStar was also required to establish an escrow account with a $55 million minimum.

Even with such commitments, it would theoretically be easier for a limited liability company to dissolve and walk away from a project than it would a nuclear utility that retained ownership of a property for decades, the first source said. Along with ES/Jingoli Decommissioning, the Holtec-SNC Lavalin venture, Comprehensive Decommissioning International, is also an LLC.

The challenges of remediating a radioactively contaminated site itself cannot be understated. While TMI-2’s short operational life limited contamination levels in some areas, the nature of the accident means “contamination [is] much more significant in unusual areas” than would be anticipated in other jobs, a third source said.

Nonetheless, FirstEnergy Corp.’s Jones expressed no concern about EnergySolutions’ ability to complete decommissioning.

“Well, I think that’s the thesis from EnergySolutions’ perspective is, that they’re good at this,” he said in response to a question during this week’s earning call. “There is plenty of money in the trust fund and they believe they can execute and decommission it for less than what’s in the trust fund with whatever is left over being their margin so to speak on the decommissioning.”

The decommissioning trust held $850 million at the end of the first quarter of 2019, company spokeswoman Jennifer Young said by email Tuesday. There was no word on the projected cost for decommissioning under the EnergySolutions-Jingoli team. As of last year, the work was estimated to cost over $1.2 billion.

Three Mile Island Unit 2 operated for only four months before the March 1979 accident. It never operated again and has been in safe-storage mode since the 1990s, with its used fuel already shipped to the Department of Energy’s Idaho National Laboratory. FirstEnergy assumed ownership of the plant in 2001 as part of its acquisition of GPU Inc.

This is FirstEnergy Corp.’s sole nuclear power plant. Subsidiary FirstEnergy Solutions operates four reactors at three sites in Ohio and Pennsylvania. It had announced plans to close all three facilities by 2021, but said this week the Ohio locations will remain open after the state approved a nuclear bailout.

Under the current FirstEnergy Corp. schedule, reactor dismantlement for Three Mile Island Unit 2 would start in 2041 and wrap up in 2053, according to Young.

Reactor Unit 1 at Three Mile Island is owned by Exelon and is scheduled to close by Sept. 30. So far, the Chicago-based power company has indicated it will retain ownership of the reactor. Its schedule calls for preliminary decommissioning and moving spent fuel into dry storage by 2022, after which active decommissioning would be delayed until the 2070s and wrap up by 2079.

“I don’t believe there was ever any plan to decommission both units together,” Jones said Wednesday. He added: “I think both Exelon and us are going to make our own decisions about how to move forward with our assets. Our decision was up until now we’ve been relying on Exelon for some support with TMI-2. And there is ongoing monitoring and things you have to do that now that they have made the decision to close TMI-1 that caused us to start looking more seriously at what we needed to do with TMI-2.”

At a meeting this week in Harrisburg, local residents urged Exelon to expedite decommissioning of its reactor at Three Mile Island, the York Dispatch reported.

Exelon did not respond to a query Thursday on the matter.